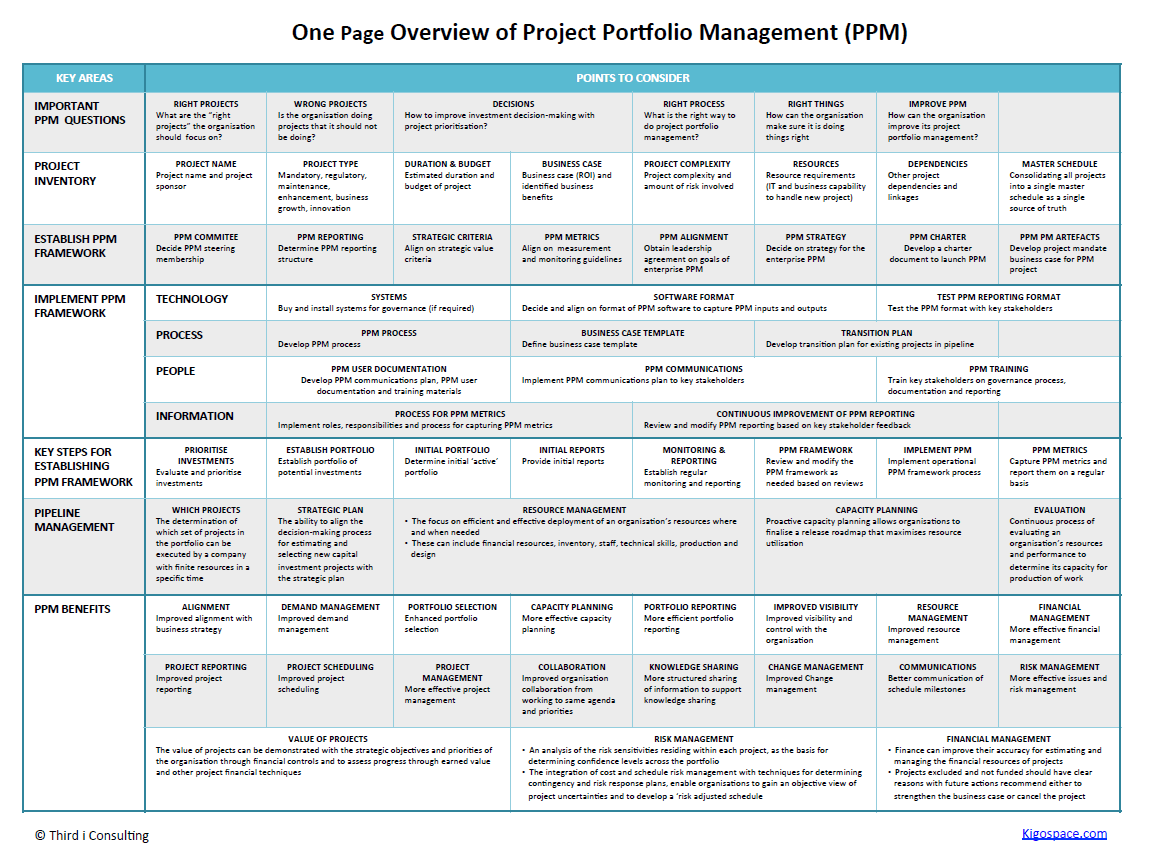

The objective of Project Portfolio Management (PPM) is to determine the optimal mix and sequencing of proposed projects.

This aims to achieve the organization’s overall business goals, typically expressed in concrete economic measures and strategic objectives.

What are the 7 Primary Benefits of Project Portfolio Management?

Effective PPM implementation strategies bring numerous benefits to organizations. Below are the 7 primary benefits of PPM that contribute to overall project success.

1. Enhanced alignment with business strategy and objectives

Effective Project Portfolio Management (PPM) enhances alignment with business strategy through demand management, portfolio assessment, capacity planning, and reporting.

These elements enable organizations to focus on projects that contribute directly to their overall goals.

2. Greater visibility and control within the organization

PPM improves visibility and control across the organization by enhancing resource management, financial oversight, project reporting, and scheduling.

This transparency empowers stakeholders to make informed investment decisions and track project performance effectively.

3. Strengthened collaboration among teams

A significant benefit of PPM is the strengthened collaboration among teams. This improvement stems from several factors, including:

- Improved interdepartmental collaboration

- Structured sharing of information to support knowledge sharing

- Change management

- Communication of schedule milestones

- Issues and risk management.

Together, these elements foster a supportive work environment that not only encourages teamwork but also drives project success.

4. Optimized Pipeline Management

The determination of which set of projects in the investment portfolio can be executed by a company with finite development resources in a specified time.

Fundamental to pipeline management is the ability to align the decision-making process for estimating and selecting new capital investment projects with the strategic project management plan.

5. Effective Resource Management

The focus is on the effective and efficient deployment of an organization’s resources where and when they are needed.

These can include financial resources, inventory, staff, technical skills, production, and design.

The continuous process of evaluating an organization’s resources and performance to determine its capacity for the production of work.

Proactive capacity planning allows organizations to finalize a release roadmap that maximizes resource utilization.

6. Improved Financial Management

Portfolio Management allows the finance department to improve its accuracy in estimating and managing the financial resources of a project or group of projects.

In addition, the value of projects can be demonstrated with the strategic objectives and priorities of the organization through financial planning and to assess progress through earned value and other project financial techniques.

7. Comprehensive Risk Management

An analysis of the portfolio risk sensitivities residing within each project as the basis for determining confidence levels across the portfolio.

Integrating cost and schedule risk management plans with techniques for determining contingency and risk response enables organizations to gain an objective view of project uncertainties and to develop a ‘risk-adjusted’ schedule.

Consequences of Ignoring Project Portfolio Management

Neglecting Project Portfolio Management (PPM) can result in misaligned projects that favor loud voices over strategic goals.

This oversight creates challenges that jeopardize project outcomes and obstruct organizational objectives. Here are the key costs associated with not using PPM:

- Misaligned projects – Million-dollar projects, which may or may not match the company’s objectives, are awarded to business units headed by the loudest executives.

- Weak governance – Weak IT governance structures mean that business executives don’t have clear ideas of what they’re approving and why.

- Inadequate business cases – The organization doesn’t build good business cases for IT projects.

- Capacity overreach – Organizations attempting to do many more projects than they have the capacity to do.

- Project prioritization issues – Bad projects squeezing out good projects.

- Lack of visibility – There is no visibility of what is being done throughout the organization.

- Project delays – Excessive project delays due to “not enough resources.”

- High turnover rates – High turnover due to “burnout” of key project contributors because they are working on too many projects.

- Frequent status changes – Frequent changes in the status of projects (i.e., moving from “active” to “on hold” to “top priority” and back).

- Misaligned outcomes – Completion of projects that, when all is said and done, don’t really meet a strategic need.

- Departmental competition – Rather than cooperation among departments, intense competition when staffing and funding projects.

This short video highlights important research about the costs of not using project portfolio management – and the benefits of implementing this approach.

10 Steps to Implement Project Portfolio Management

To implement Project Portfolio Management (PPM) organizations should follow best practices and take strategic plans that promote collaboration and clarity. This process involves the following:

- Gain stakeholder alignment on goals for PPM.

- Obtain senior management support for the PPM.

- Develop an implementation strategy for a PPM framework.

- Align with key stakeholders on criteria for decisions and prioritization for projects within the project portfolio.

- Decide what tools will be used to support the PPM meetings to record and report decisions.

- Determine the reporting requirements for different stakeholders in terms of format, frequency, and medium.

- Decide how the PPM framework will be monitored and measured and how it will be continuously improved.

- The PMO will facilitate the design of the PPM process with key stakeholders as part of the project deliverables that will be signed off by the PPM steering committee.

- The PMO will communicate the PPM roles and responsibilities and the PPM process, as well as provide end-user training for the PPM process and templates.

- The PMO will facilitate the testing of the PPM process, templates, and tools with key stakeholders as part of a pilot.

The 17-Point Project Portfolio Management Process

PPM helps ensure that projects contribute positively to overall business success.

This process involves essential steps organizations must follow to optimize project selection, enhance resource allocation, and ensure alignment with strategic objectives.

1. Establish a Robust Evaluation Process

A good evaluation process can help organizations detect overlapping project proposals upfront, cut off projects with poor business cases earlier, and strengthen alignment between IS and business senior managers.

2. Prioritize Projects for Optimal Funding

After evaluating projects, most companies will still have more than they can fund.

The strength of portfolio management is that, ultimately, the prioritization process will allow an organization to fund and resource the projects that most closely align with your company’s strategic objectives.

3. Compile a Comprehensive Project Inventory

Strategic portfolio management begins with gathering a detailed inventory of all the existing and proposed projects in your organization.

It is ideal to have this information in a single database. The inventory should include the project name, length, estimated cost, business objective, ROI, and business benefits.

4. Centralize Project Data for Visibility

Consolidating all projects into a single central repository provides visibility and control of your organization’s entire workload.

5. Maintain a Single Source of Truth

This is required to maintain a single source of truth for work demands and to make informed allocation decisions.

6. Develop a Master Project Schedule

Put the inventory into a master project schedule to gain an understanding of the resource requirements of all the projects.

7. Create a Standardized Intake Process

Create a standardized intake process for new project proposals.

8. Implement a Consistent Evaluation Process

Develop a standardized process for evaluating a portfolio of project requests, prioritizing the requests, and approving or rejecting requests.

9. Standardize Evaluation Methods

Standardization allows for consistent methods of evaluation and decision-making.

10. Define Strategic Goals and Objectives

Formalize the definition of strategic goals and objectives to support portfolio prioritization and selection.

You must define the business driver and impact measures, as well as prioritize business drivers.

11. Assess Project Impact

Assess the impact of new projects on the business drivers.

12. Optimize Project Selection for Maximum Return

Maximizing portfolio return starts with optimizing the selection of projects to pursue.

13. Facilitate Fact-Based Decision-Making

Comparing objective priority scores across projects makes fact-based decision-making discussions possible. Prioritize the projects against weighted criteria as:

- Financial valuation

- Strategic alignment

- Project priorities

- Resource availability

- Project complexity

- Organizational capability for change.

14. Conduct Project Portfolio Selection

Perform project portfolio selection and sift out the ones with questionable business value either placed “above the line” (those projects that should be funded) or “below the line” (those that shouldn’t).

15. Support Decisions with Portfolio Reporting

Portfolio reporting supports portfolio selection discussions by providing a common and consistent view of the entire project portfolio to decision-makers.

16. Plan and Assign Resources Effectively

Schedule and allocate resources to the entire project portfolio, supported by detailed project planning.

17. Monitor the Portfolio Regularly

Regular portfolio monitoring to ensure successful project delivery, ongoing project tracking and reporting, and portfolio realignment. This process begins with effective project initiation to set the stage for all subsequent steps.

Editors note: This post has been updated for freshness, comprehensiveness, and accuracy. This post and One-Page Plan was provided by Ken Martin.

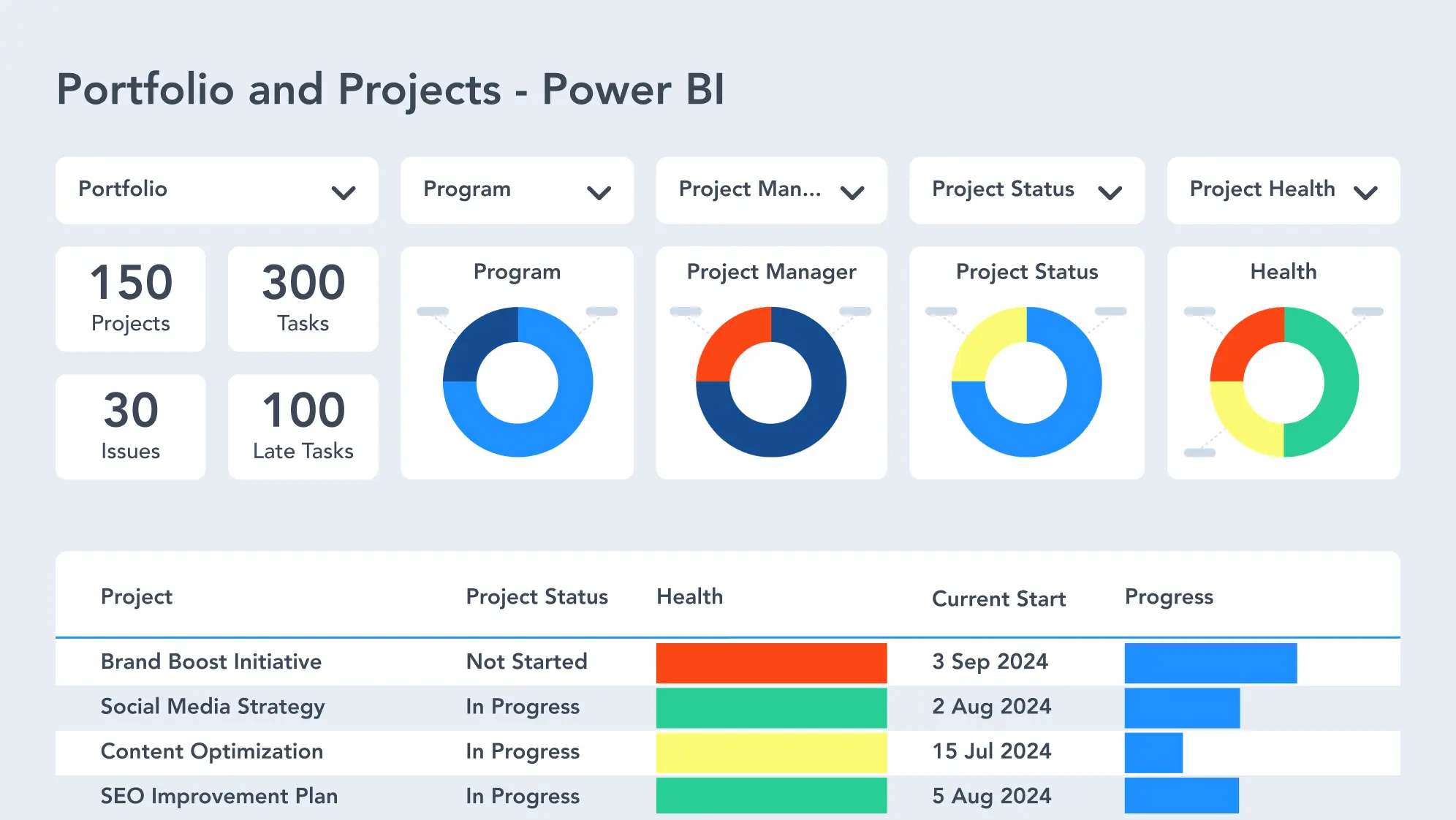

Standardize your project management processes with Microsoft 365

Watch a demo of BrightWork 365 project and portfolio management templates for Microsoft 365, Power Platform, and Teams.